At U-Capital, our Corporate Finance Advisory (CF&A) team brings together seasoned experts to deliver comprehensive financial solutions tailored to your business needs. We provide strategic guidance and actionable insights at every stage of a transaction, from exploring strategic options to executing complex deals such as IPOs, acquisitions, divestitures, restructurings, or expedited disposals.

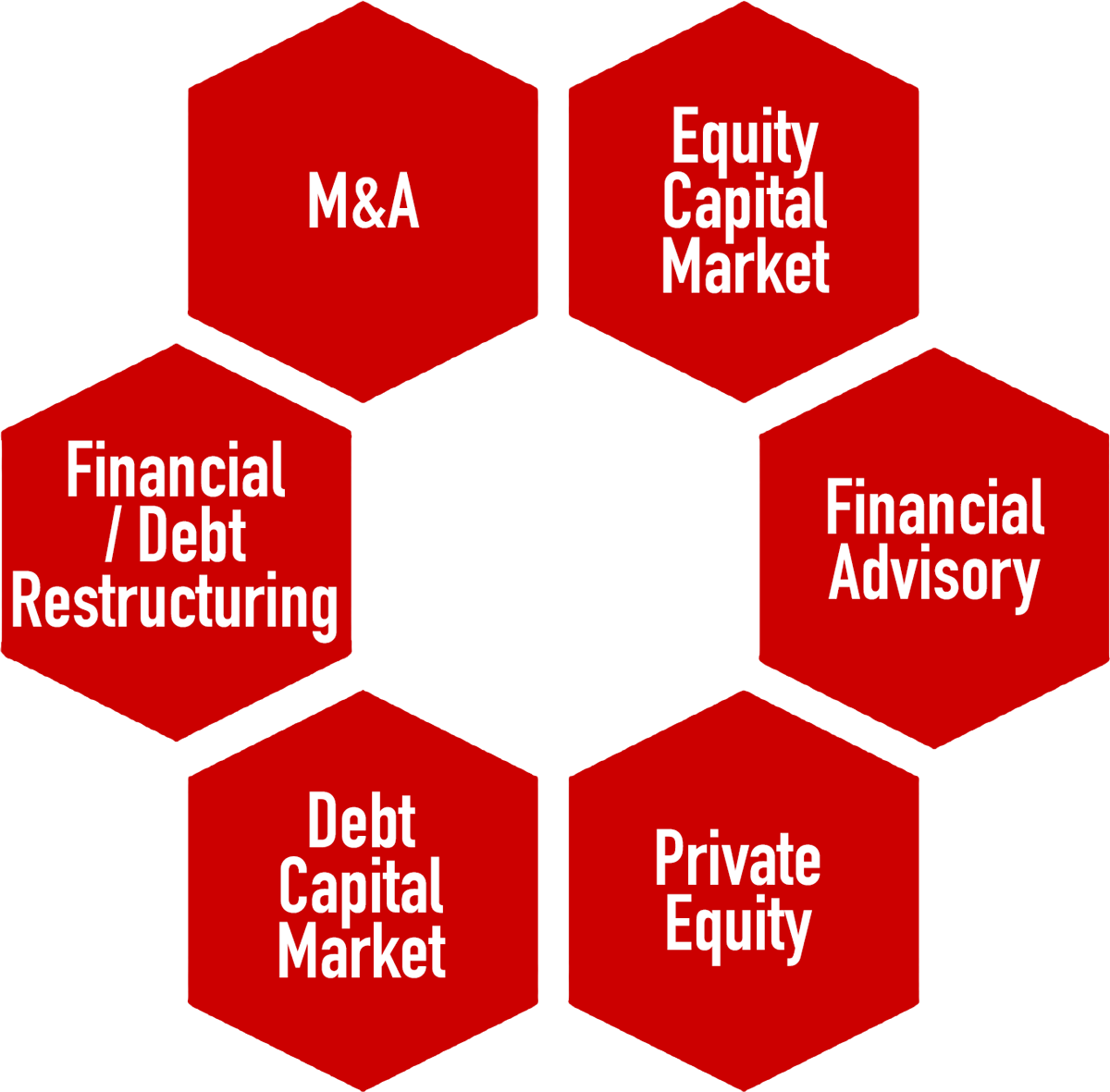

With extensive experience across diverse sectors—including Banking, Mining, Construction, Utilities, Industrial, and Food—our CF&A team offers customized solutions spanning Equity and Debt Capital Markets, Strategic Advisory, Private Placements, and Mergers & Acquisitions. Leveraging deep expertise and robust fundraising capabilities, U-Capital is your trusted partner for achieving strategic success.

We deliver cutting-edge solutions, blending global best practices with deep financing and structuring expertise. With over 100 years of combined experience, we excel in executing high-stakes transactions, driving impactful results for your business

The team delivers unmatched fundraising prowess, raising ~US$11B across deals. Leveraging our extensive global investor network and sharp expertise, we craft tailored solutions that exceed stakeholder expectations

The team has led transformative transactions, including Alizz Islamic Bank’s acquisition, IPOs for National Life & General Insurance, Bank Nizwa, Bank Sohar, Galfar, and Voltamp, and bond issuances for OAB, National Finance, Taageer Finance, Muscat Finance, and Ominvest.

We provide end-to-end post-transaction services, including research coverage, ongoing monitoring for future fundraising, and investor relations support, ensuring sustained success and strong stakeholder engagement.

We adopt a Holistic Approach, blending Client and Industry Knowledge together with Product Advisory to create Customized Solutions that address our Clients’ Strategic Needs.